The Credit Reference Bureau in Kenya

The Credit Reference Bureau in Kenya

A Credit Reference Bureau (CRB) is an institution established to monitor the behavior of borrowers with the objective of enabling credit providers to overcome the challenge of Non-performing loans (NPLs) and reduce the loan default risk.

DIRECTORY OF THE 3 LICENCED CREDIT REFERENCE BUREAUS

|

1.Credit Reference Bureau Africa Limited (Trading as TransUnion) Ag. Chief Executive Officer: Ms. Rose Kinuthia Postal Address: P.O. Box 46406 – 00100, Nairobi Telephone: +254 – 020 – 3751799/3751360/2/4/5 Fax: +254 – 020 – 3751344 E-mail: [email protected] Website: www.crbafrica.com Physical Address: CRB Centre, Prosperity House, 2nd Floor, Westlands Road, Nairobi

|

|

2. Metropol Credit Reference Bureau Limited Managing Director: Mr. Sam Omukoko

|

|

3.Creditinfo Credit Reference Bureau Kenya Limited Ag Chief Executive Officer: Mr. Stephen Kamau Kunyiha Postal Address: P.O. Box 38941 – 00623, Nairobi Telephone: +254 – 020 – 3757272 E-mail: [email protected] ; [email protected] Website: www.creditinfo.co.ke |

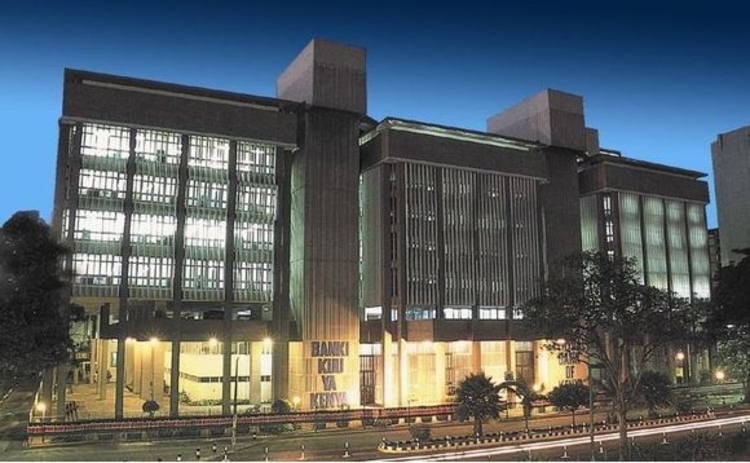

In Kenya there are three CRBs among them is CREDITINFO and they are all regulated by the Central Bank of Kenya. They receive credit data from various sources such as Banks, Saccos, Micro Finance Banks Micro Finance Institutions and FinTech’s. The CRB uses this data to build a credit history on individuals, then share to credit lending institutions and individual consumers.

Credit lenders use bureau information to assess the risk of their borrowers and determine the loan to give out. Credit bureaus are not responsible for deciding whether an individual should have credit (loan) extended to them. This is strictly the function of the lending institution.

What is meant by credit history? Credit history is basically a record of a borrower’s ability to pay back his/her loans. Credit history comprises of the following details.

- The number of credit accounts and loans

- How long each account has been open

- Loan principal amount

- Loan balance

- Loan repayment and consistency

- Recent credit inquiries

This means that if you have a credit card or a loan from a bank, you have a credit history. The credit history is compiled by the CRB and presented in one place called the credit report.

Apply for your credit report