Share this

The Future of Money: MPESA

A “mobile money” revolution has swept Kenya, where people can send and receive money on their cell phones. It’s improved commerce and brought basic necessities to poorer areas

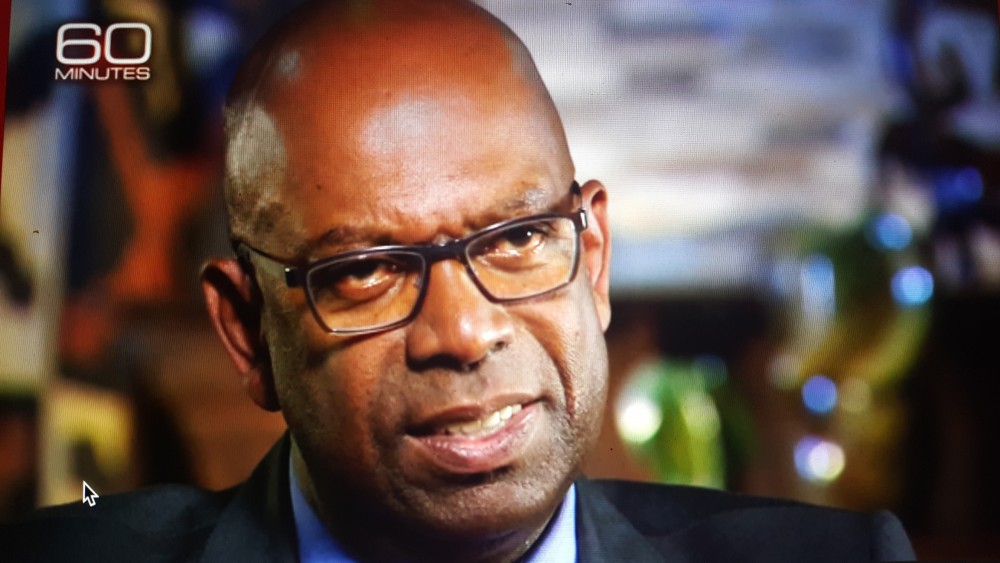

The following is a script from “The Future of Money” which aired on Nov. 22, 2015. Lesley Stahl is the correspondent. Shachar Bar-On and Alexandra Poolos, producers.

Tech giants like Google, Facebook, and PayPal are all steadily rolling out new-fangled services to turn our smartphones into digital wallets — replacing cash and checks. And it’s been reported that Apple is working on a new payment option to let iPhone users send money directly to one another — as easily as a text message.

If this all seems cutting edge, you may be surprised to learn there’s one country that adopted mobile money years ago: Kenya. Here in the U.S., we can use smartphones to pay for things, but you typically need to be linked to a bank account or credit card. In Kenya, you don’t need a bank account, you don’t need a credit history, or very much money for that matter, making this country in East Africa a giant experimental laboratory defining the future of money.READ MORE