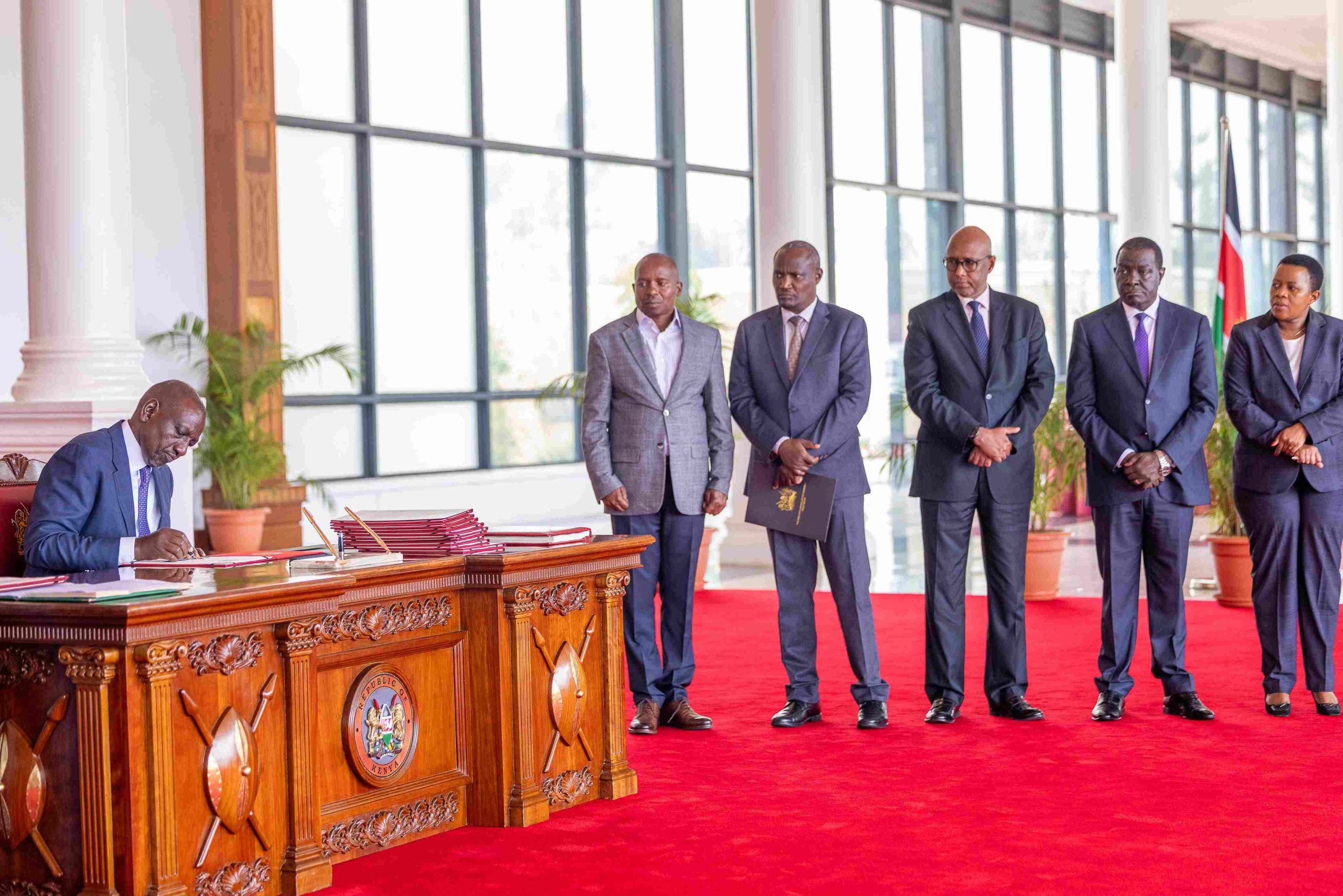

President William Ruto on Thursday signed into law the Finance Bill 2025, the Appropriation Bill 2025 and the Supplementary Appropriation (No. 3) Bill 2025, ushering in sweeping tax changes and unlocking Sh1.88 trillion for government spending in the 2025/2026 financial year.

The new laws aim to raise revenue through expanded tax bases and support critical sectors such as agriculture, health, education, and infrastructure in line with the Bottom-Up Economic Transformation Agenda.

The Finance Act introduces changes to six tax-related laws, including the Income Tax Act, the Value Added Tax Act, and the Excise Duty Act.

It provides automatic reliefs and exemptions for employees, exempts pension-related gratuities from taxation, and lowers the capital gains tax rate from 15 to 5 per cent for large investments approved by the Nairobi International Financial Centre Authority.

The Bill amends the Income Tax Act to mandate employers to apply all applicable reliefs, deductions and exemptions to an employee automatically,” the brief states.

To stimulate the digital economy, the law repeals the Digital Assets Tax and replaces it with a 5 per cent excise duty on transaction fees paid to virtual asset providers.

It also introduces a 10 per cent excise duty on virtual asset service fees, expands taxation on digital services by non-residents, and alters income tax rules on betting to apply to withdrawals by punters.

“The lower excise duty will promote innovation and enhance investments in digital assets,” the statement notes.

In the Value Added Tax Act, exemptions have been granted on mosquito repellents, machinery for local production, and packaging materials for tea and coffee.

The Excise Duty Act now imposes a 5 per cent tax on deposits into betting, gaming, and lottery wallets, while licensed micro-distillers have been exempted from costly automation requirements to boost local manufacturing.

The Appropriation Act now authorises the National Treasury to withdraw Sh1.88 trillion from the Consolidated Fund and allows ministries, departments, and agencies to utilise an additional Sh672 billion in internally generated revenues.

Of the total, Sh1.81 trillion will go to recurrent spending and Sh744.5 billion to development.

To strengthen food security, the agriculture sector will receive Sh47.6 billion for programmes including a fertiliser subsidy, coffee debt waiver, and the blue economy.

The law allocates Sh18 billion for agro-industrial parks, SEZ textile parks, and MSME support under the Kenya Industrial Estates.