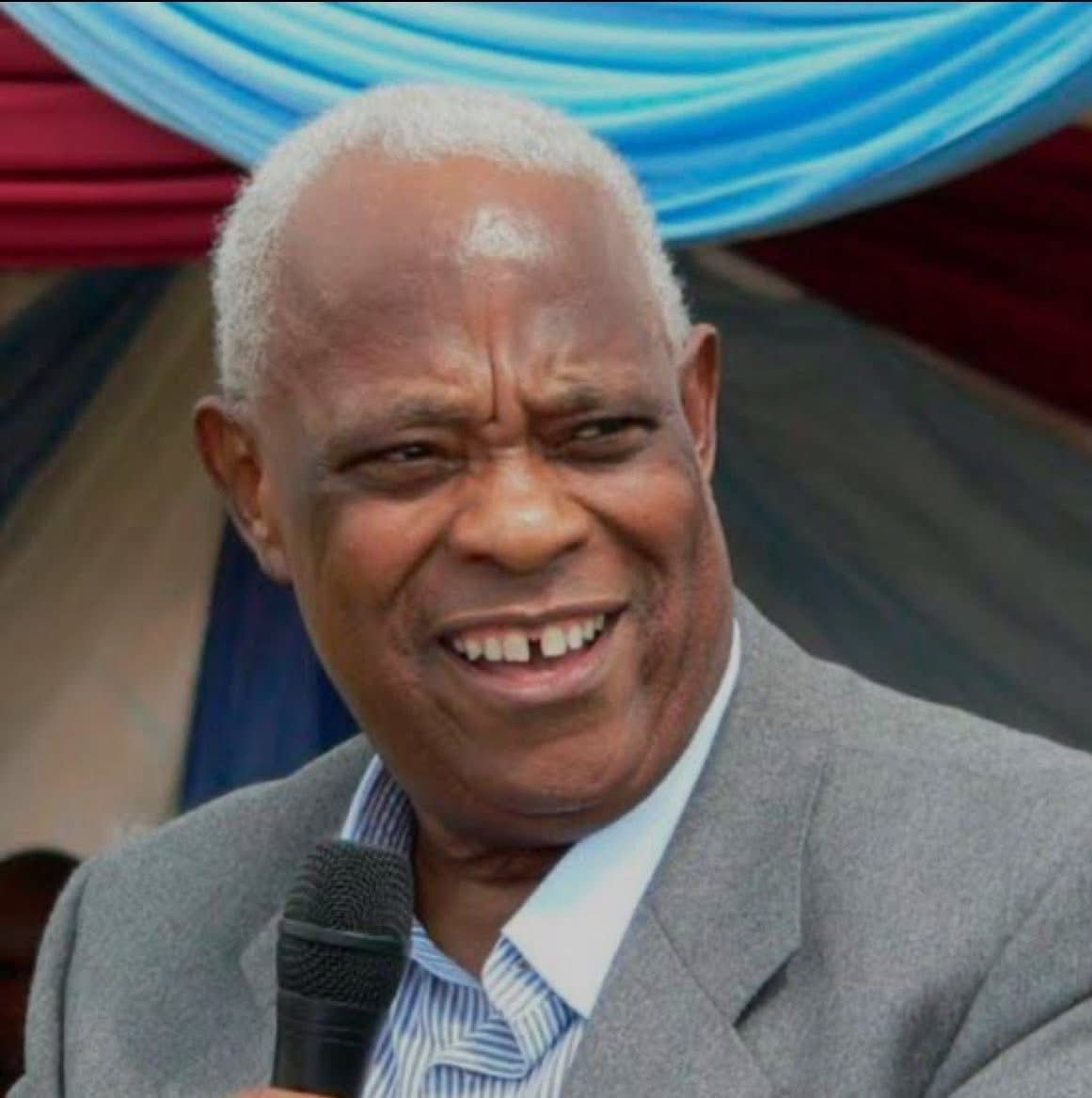

Muhoho Kenyatta Appointed to NCBA Board

NCBA Group PLC has announced the appointment of Muhoho Kenyatta as a Non-Executive Director.

In a notice on Wednesday, November 26, the Group Managing Director, John Gachora, announced that Muhoho’s appointment as a Non-Executive Director is effective December 1, 2025.

“The Board congratulates Kenyatta on his appointment and welcomes him to the NCBA Group PLC Board,” read part of the notice.

Kenyatta is an accomplished business executive with over 35 years of experience leading and developing businesses across East Africa, spanning diverse sectors such as manufacturing, healthcare, insurance, and banking.

Muhoho Kenyatta profile

He has previously served on the boards of several national and industry development organisations, including the Kenya Association of Manufacturers, Kenya Private Sector Alliance, Kenya Dairy Board, Kenya Dairy Processors’ Association, Kenya Shippers Council, and Kenya Sisal Board, among others.

Kenyatta has previously served as Deputy Chairman of one of the predecessor institutions of NCBA between 2000 and 2019, and as a director of NCBA Bank Uganda.

He continues to support the Group’s digital strategy as a member of the Board of LOOP DFS Limited, a wholly owned subsidiary of NCBA Group PLC.

“He brings to the NCBA Group Board a strong track record in business leadership, governance, and strategic growth.”

Muhoho holds a Bachelor of Arts (Hons) degree in Economics and Political Science from Williams College, Massachusetts, USA, and a Pan-African Advanced Management Program Certification jointly offered by IESE Business School, University of Navarra (Spain), and Strathmore University Business School. He also holds several executive leadership and corporate governance certifications.

About NCBA Group PLC

His appointment comes after NCBA posted Ksh16.4 billion profit after tax in its Q3 2025 financial results, up 8.5% year-on-year.

Operating income grew 13.8% to Ksh53.4 billion, while loan loss provisions increased to Ksh5.1 billion in the first nine months of the year.

Total assets stood at Ksh665 billion, and customer deposits closed at Ksh488 billion. The Group also disbursed Ksh1 trillion in digital loans over the period.

NCBA Group is primarily owned by the family of former Central Bank of Kenya (CBK) Governor Philip Ndegwa, which, as of December 2024, had overtaken the Kenyatta family to become the largest shareholder. Through First Chartered Securities Limited, the Ndegwa family held a 14.94% stake as of December 31, 2024.

The Kenyatta family holds a 13.20% stake in NCBA through Enke Investments Limited, followed by D&M Management Services LLP, which owns 11.54% and completes the Group’s top three shareholders.

NCBA Bank’s origins trace back to the merger of National Industrial Credit (NIC) and the Commercial Bank of Africa (CBA). In 2018, the two institutions initiated merger discussions with the goal of forming a stronger, unified banking group.

The merger was recommended, approved by shareholders in April 2019, and finalized with regulatory clearance effective October 1, 2019.

The combined entity, NCBA Group Plc, emerged as Kenya’s third-largest bank by assets, bringing together more than a century of collective banking experience.

Reports of merger with Standard Bank Group

In October 2025, NCBA Group saw its share price surge following reports by Bloomberg of a possible acquisition by Standard Bank Group, the parent company of Stanbic Bank Kenya.

Shares of NCBA jumped from Ksh69 to Ksh76.25 on Tuesday, October 14, while Stanbic’s stock also edged up to Ksh199, reflecting strong investor interest. On Wednesday, October 15, NCBA Group extended its rally, gaining another 8% to close at KES 81.25 [+69% YTD], building on Tuesday’s 8.3% surge.

According to Bloomberg, the two banks reportedly entered discussions to merge operations, a move that could create Kenya’s third-largest lender by assets — estimated at Ksh1.1 trillion ($8.5 billion).

Although sources have indicated that the deal is still under negotiation, it’s viewed as a strategic consolidation that could significantly shift the balance of power in Kenya’s financial services sector.

Reacting to the Bloomberg reports, Stanbic Bank responded:

“Stanbic Holdings Plc notes the media speculation in relation to a potential transaction. Stanbic Holdings Plc however does not comment on market or media speculation and any material developments regarding potential corporate activity will always be communicated through the appropriate channels, in accordance with our regulatory obligations and stock exchange listing requirements.

Currently, Equity Group Holdings Plc and KCB Group Plc are the top two banks by asset base.