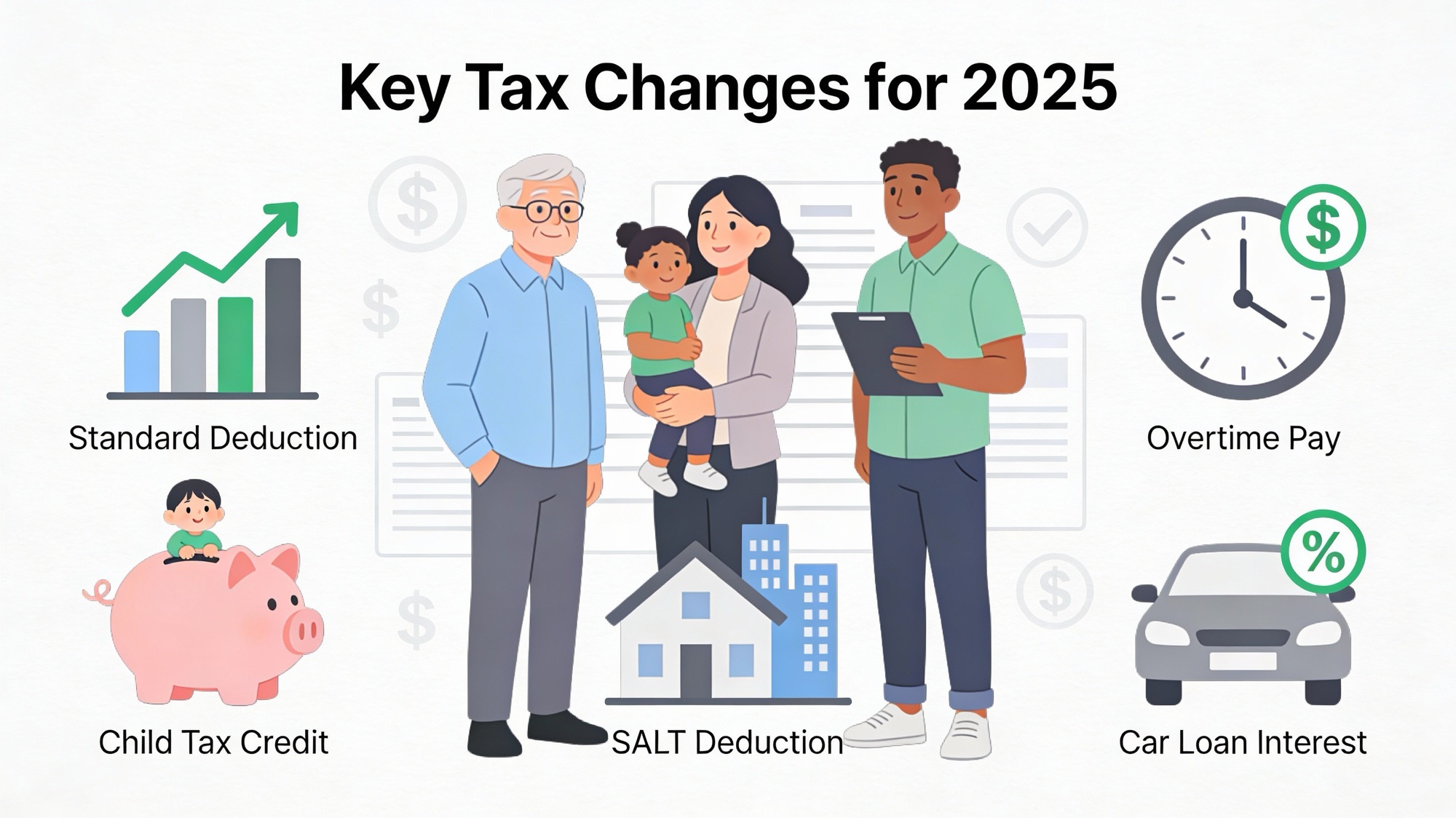

Key Tax Changes for 2025: New Deductions, Bigger Credits, and How They Affect Your Refund”

Bigger deductions and updated brackets

• The standard deduction rises to $15,750 (Single), $31,500 (Married Filing Jointly), and $23,625 (Head of Household) for 2025, roughly an 7–8% increase over 2024.

• Tax brackets stay in the current 10%–37% structure, but the income thresholds are adjusted upward for inflation, so a bit more income is taxed at lower rates.

Child Tax Credit and SALT cap

• The Child Tax Credit is made permanent at a higher level and increased to $2,200 per qualifying child, with amounts indexed for inflation going forward; a valid Social Security number is required for the child.

• The long‑controversial SALT (state and local tax) deduction cap jumps from $10,000 to $40,000 for 2025 (with adjustments in later years), although the benefit phases down for very high‑income households.

Four new deductions: tips, overtime, seniors, car loans

• A new “No Tax on Tips” deduction allows qualifying service‑industry workers to deduct a large portion of their 2025 tip income (up to $25,000 in some cases) from taxable income, subject to income limits and documentation rules.

• A parallel “No Tax on Overtime” deduction lets eligible employees deduct up to $12,500 of qualified overtime pay ($25,000 for joint filers) from income between 2025 and 2028, again with phase‑outs at higher earnings.

• Adults 65 and older can claim a new Senior Deduction of $6,000 on top of the standard or itemized deduction for 2025–2028, though this extra amount begins to phase out once modified AGI exceeds about $75,000 ($150,000 for couples).

• A “No Tax on Car Loan Interest” deduction lets individuals deduct up to $10,000 per year of interest on loans for qualifying U.S.‑made personal vehicles purchased from 2025 through 2028, phasing out over $100,000 of income ($200,000 for joint filers).

Other important 2025 provisions

• Energy‑related incentives change sharply: the federal Electric Vehicle Credit and several clean‑energy home improvement credits are scheduled to end or shrink for purchases after September 30, 2025.

• The 20% Qualified Business Income deduction for many pass‑through business owners is made permanent, with higher income phase‑in ranges starting around $75,000 for single filers and $150,000 for joint filers.

• The law also preserves a higher estate‑tax exemption, boosts the Alternative Minimum Tax exemption, and continues limits on certain itemized deductions like personal casualty losses and miscellaneous employee expenses.

What this means for everyday taxpayers

• Most households will see lower taxable income in 2025 simply from the larger standard deduction and higher Child Tax Credit, even if they do nothing differently.

• Workers who earn tips or significant overtime, seniors 65+, and people buying new U.S.‑made vehicles during 2025–2028 have unique opportunities to reduce taxes if they track their income and loan paperwork carefully.

• Because many deductions now phase out at specific income levels, reviewing withholding and estimated payments early in the year can help avoid surprises when filing 2025 returns in 2026.