Kenya Remittances Shift as UK Surges Past Saudi Arabia, CBK Data Shows.

Kenya Remittances Shift as UK Surges Past Saudi Arabia, CBK Data Shows.

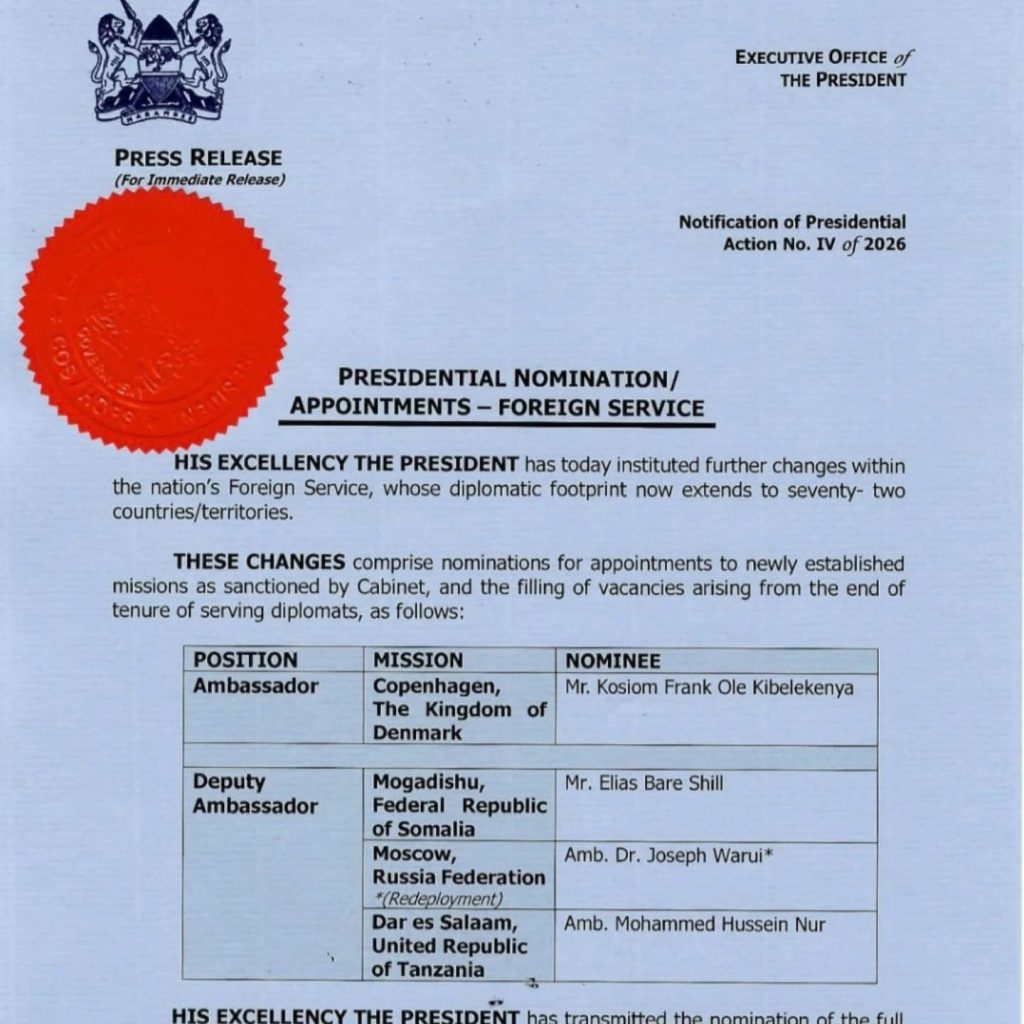

The United Kingdom has emerged as Kenya’s second‑largest source of diaspora remittances in 2025, according to new data from the Central Bank of Kenya, marking the end of a three‑year period in which Saudi Arabia held that position. Remittance inflows from the UK recorded a modest rise to $360.2 million (Sh46.47 billion), while transfers from Saudi Arabia declined to $302.1 million (Sh38.97 billion). Diaspora organisations attribute the slowdown in Gulf inflows to higher transaction costs following the introduction of a 15% VAT on remittance service fees, as well as labour‑market adjustments that affected employment contracts and earnings.

CBK data indicates that average monthly remittances from Saudi Arabia fell from $33.59 million in 2024 to $25.17 million in 2025, with some workers opting for local savings or informal transfer channels. The United States maintained its position as Kenya’s leading remittance source, contributing 54.23% of the total $5.04 billion received in 2025. However, analysts note that future inflows may face headwinds following the introduction of a 1% excise tax on outbound remittances in the US, effective January 1, 2026. @mudavadi.musalia @franc_isatwoli

@state.house.kenya @roseline.njogu @korir_singoei

Congratulations to Kenyans in the UK for Strengthening Inflows and Expanding Opportunities that help build Kenya’s Economy.