IMF Warns Kenya of Currency Risks After Swapping Dollar Loan for Yuan

The International Monetary Fund (IMF) has warned Kenya of potential currency risks after the country converted dollar-denominated loans from China into yuan as part of efforts to reduce debt costs.

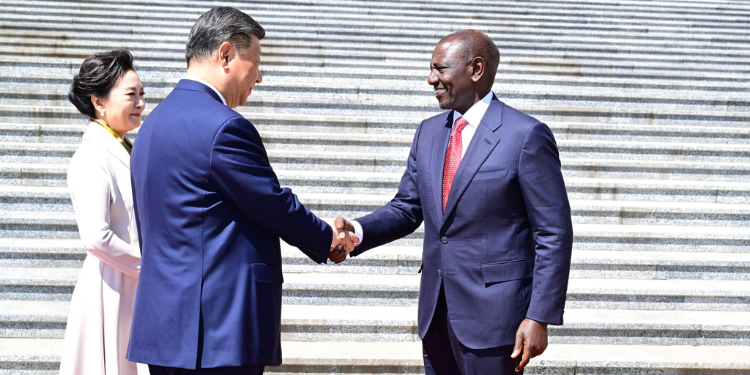

This comes after Kenya finalized a currency conversion deal with China in October of this year for its Standard Gauge Railway (SGR) loans.

The move is expected to save the country approximately $215 million (Ksh27.79 billion) annually in debt servicing costs.

The announcement was made by Treasury Cabinet Secretary John Mbadi, who confirmed that the government successfully converted part of its Chinese railway debt from U.S. dollars to Chinese yuan (renminbi) following talks with China.

“Presently, our debts are so concentrated in one currency, in dollar terms, especially external debts,” the CS said, as quoted by Bloomberg.

“We are trying to spread that risk by diversifying currencies. That is why we approached the Chinese government to discuss how we could convert some of the debts that are in dollars to renminbi.”

IMF Warns Kenya of Currency Risks After Swapping SGR Dollar Loan for Yuan

However, according to the IMF, switching currencies may lower costs, but can also introduce currency risks depending on their structure.

IMF stated that switching currencies is a proactive approach to debt management, but countries must ensure that the benefits from these moves don’t create new vulnerabilities.

“While these transactions may lower costs, they can also introduce currency risks depending on their structure.

“IMF encourages countries to consider such operations within comprehensive medium-term debt and reserve management strategies to ensure an appropriate balance between cost and risk.”

This comes amid reports that Kenya has been pushed to convert dollar-denominated SGR debt into Chinese yuan by powerful Western lenders, including the World Bank and the IMF.

President William Ruto’s economic adviser, David Ndii, revealed that multilateral lenders were worried that Nairobi was using their dollar loans to pay China rather than funding the nation’s infrastructure and budget.

“The Western lenders questioned why they ought to help us while other lenders were taking out the money. For this reason, they exert pressure on nations to restructure their debts so that the funds they invest remain in the nation rather than being used to pay off other lenders,” Ndii explained.

Kenya had borrowed $5 billion (approximately Ksh646 billion) from the Export-Import Bank of China to finance the SGR line connecting the port city of Mombasa to the outskirts of Nairobi.

As of June 2024, about $3.5 billion (approximately Ksh452.375 billion) of that debt remained outstanding, according to the government’s debt register. Kenya currently spends roughly $1 billion (approximately Ksh129.25 billion) annually on servicing its debt obligations to China.